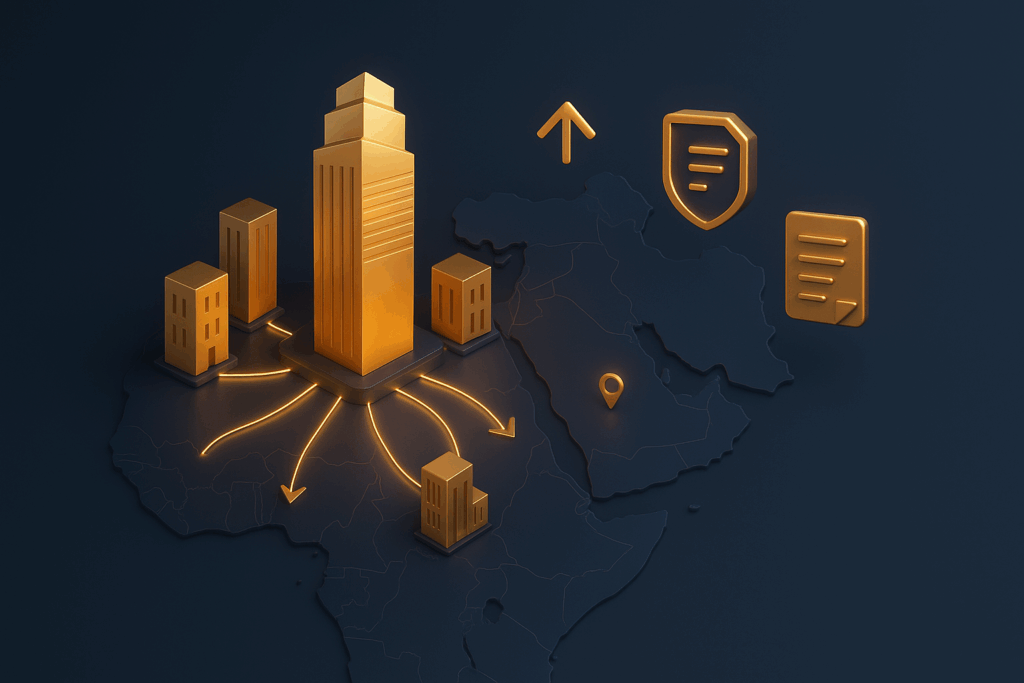

Holding Company Structures in the MENA Region: Opportunities and Pitfalls

Introduction The Middle East and North Africa (MENA) region has become an increasingly attractive location for establishing holding company structures. Multinationals and regional groups alike use holding companies to centralize ownership, streamline cross-border operations, optimize taxes, and enhance asset protection. However, despite the advantages, holding structures in MENA come with regulatory, tax, and operational challenges. […]

Holding Company Structures in the MENA Region: Opportunities and Pitfalls Read More »